About loan

|

|

|

|

Loan amount |

|

| Interest rate |

25% |

|

Loan term |

10 year |

|

Initial payment |

25 % |

|

Loan repayment method |

Аnnuity |

MORTGAGE LOAN GRANTING PROCEDURE

The procedure for granting mortgage loans for the purchase of housing on the primary and secondary market for the population with the funds of the Uzbekistan Mortgage Refinancing Company is carried out in the following stages:

Stage 1. Depending on the solvency of the citizen, he/she chooses housing, which is sold on the primary or secondary market of his/her choice, and signs a contract with a contracting organisation.

Stage 2. The citizen submits an application to the branches of a commercial bank requesting a mortgage loan for the purchase of the selected flat, as well as the necessary documents.

Stage 3. After reviewing the application, the Bank allocates a mortgage loan to the potential borrower.

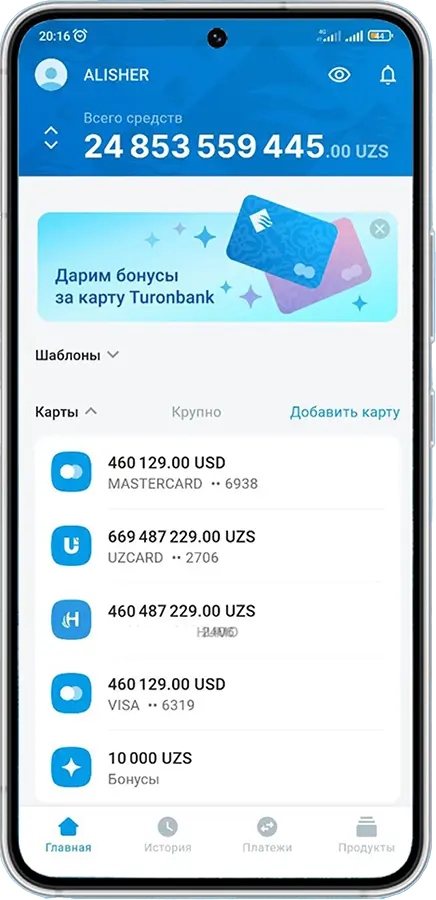

Download the MyTuron mobile application via PlayMarket or Appstore

Loan terms

Format: xlsx

You can apply for a loan at a Bank branch or on the website. Online applications are accepted around the clock and are processed quickly.

Fill in the online application form. Our employee will contact you and tell you about the conditions of registration and issue.